Does Paypal Merchant Services Report Credit Card Sales To The Irs

New U.Southward. Revenue enhancement Reporting Requirements: Your Questions Answered

How these new tax reporting changes may bear upon you when paying or accepting payments with PayPal and Venmo for goods and services

Updated: March 4th, 2022

Recently, there have been some questions regarding changes U.S. tax reporting requirements that could bear on the information PayPal shares with the Internal Acquirement Service (IRS) almost transactions made using PayPal and Venmo for the sale of appurtenances and services. We've answered some of the most pressing questions below – and we'll be sure to keep this listing updated as more details are finalized.

Q: Will I have to pay taxes when sending and receiving money on PayPal and Venmo - what exactly is changing?

Beginning January ane, 2022, the Internal Revenue Service (IRS) implemented new reporting requirements for payments received for goods and services, which volition lower the reporting threshold to $600 for the 2022 tax season, from 2021's threshold of $20,000 and 200 transactions. Here'southward some more detail:

- 1099-M Threshold Alter:

- This new Threshold Change is but for payments received for appurtenances and services transactions, so this doesn't include things similar paying your family unit or friends back using PayPal or Venmo for dinner, gifts, shared trips, etc.

- This change was introduced in the American Rescue Plan Deed of 2021, which amended some sections of the Internal Acquirement Code to require Third-Party Settlement Organizations (TPSOs), like PayPal and Venmo, to report appurtenances and services transactions made past customers with $600 or more than in almanac gross sales on 1099-G forms. Currently, a 1099-K is only required when a user receives more than $xx,000 in goods and services transactions and more than 200 goods and services transactions in a calendar twelvemonth.

Q: Volition the updated 1099-K Threshold Alter apply if I sell personal property, similar a couch or an particular at a garage sale, for $600 or more if information technology was sold for less than its original value? Will I exist issued a Form 1099-Chiliad?

Course 1099-K is an IRS informational tax form that is used to report goods and services payments received past a business or individual in the calendar year. While banks and payment service providers, similar PayPal and Venmo are required by the IRS to send customers a Form-1099K if they meet the $600 threshold amount, there are certain amounts that may be included on the grade that are by and large excluded from gross income and therefore are not subject to income taxation. This includes:

- Amounts from selling personal items at a loss

- Amounts sent every bit reimbursement

- Amounts sent every bit a gift

So, for example, if you purchased a burrow for $1200 and sold it for $800, this amount would not be subject to income tax.

Nosotros encourage customers to speak with a taxation professional when reviewing their 1099-Ks to determine whether specific amounts are classified every bit taxable income.

Q: What is a Goods and Services payment with PayPal and Venmo?

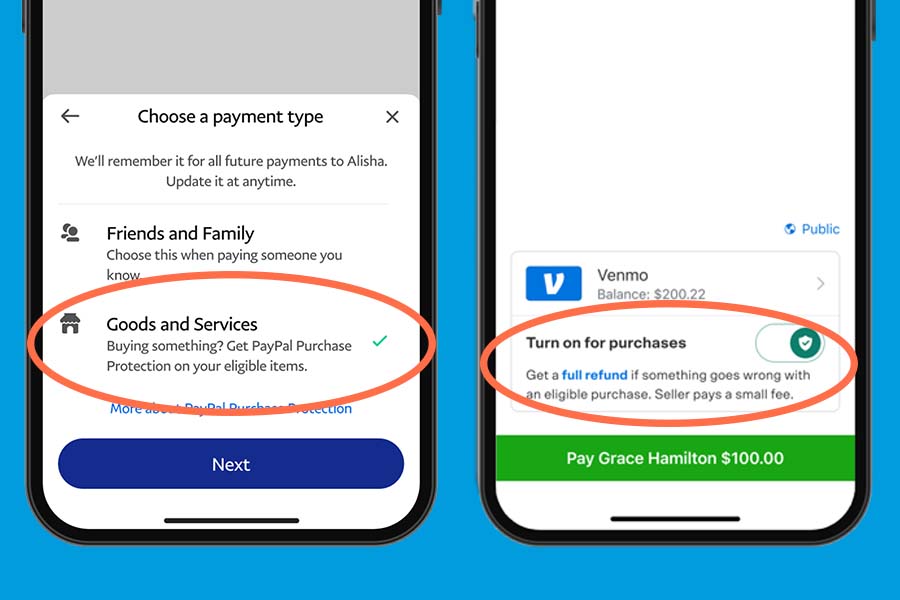

View Image

Both PayPal and Venmo offer a way for customers to tag their peer-to-peer (P2P) transactions as either personal/friends and family or goods and services by choosing the appropriate category for each transaction. Users should select Appurtenances and Services whenever they are sending money to another user to purchase an item, like a couch from a local advertizement listing or concert tickets, or paying for a service. These transactions are also eligible for coverage under PayPal and Venmo'south Purchase Protection Program. Goods and services payments are designed to provide both buyers and sellers peace of mind knowing that they may be covered if the transaction doesn't become as expected.

You lot can observe out more on PayPal Goods and Services transactions here, and Venmo Goods and Services transactions hither. Terms and weather condition apply*

Q: Is the 1099-Yard Threshold Change specific to PayPal and Venmo?

No. This is manufacture wide for all Third-Political party Settlement Organizations (TPSOs) that you may utilise to accept payments for the sale of goods and services.

Q: When do these changes come into effect?

The 1099-K change took effect January one, 2022. PayPal and Venmo volition be required to provide customers with a 1099-M course if they receive $600 or more than in appurtenances and services transactions during the 2022 tax year.

This ways you will need to take into business relationship the Threshold Change with your Tax Yr 2022 filings.

Q: What is a Form 1099-One thousand?

Grade 1099-K is an IRS informational tax course used to report payments received by a business concern or private for the sale of goods and services that were paid via a third-political party network, often referred to as a TPSO or credit/debit bill of fare transaction. The IRS requires TPSOs, such as PayPal and Venmo, to effect a Form 1099-K, which shows the full amount of payments received from a TPSO in the calendar year. Taxpayers should consider this amount with their taxation advisor when calculating gross receipts for their income tax return. For more information, visit the IRS website here.

Q: What exercise I need to do in 2022 when the 1099-K Threshold Change takes outcome?

You may notice that in the coming months we volition enquire you for your tax information, like a Social Security Number or Taxation ID, if you haven't provided it to us already, in order to keep using your account to take payments for the sale of goods and services transactions and to ensure there aren't any bug as these changes take outcome in 2022. This helps us meet our obligations to the IRS and ensures that you volition be able to continue using your account and access PayPal and Venmo features and services.

For the 2022 tax year, yous should consider the amounts shown on your Grade 1099-K when calculating gross receipts for your income revenue enhancement return. The IRS will be able to cross-reference both our written report and yours.

Q: Haven't I always had to declare my income from the sale of goods and services transactions? What'southward dissimilar?

Reporting and declaring whatsoever income, either personal or through a business organisation, has always been a requirement when filing your taxes with the IRS. The change broadens the scope of reporting such that all TPSOs, like PayPal and Venmo, need to collect revenue enhancement data in one case y'all near or attain $600 in goods and services transactions (instead of the prior threshold of $xx,000 and 200 transactions), and so that we can remain compliant with our regulatory requirements and share those details with the IRS.

This modify impacts every fiscal establishment and TPSO that you might utilise to transact for goods and services, not just PayPal and Venmo. This includes your bank accounts, and other ways you transport and receive coin.

Q: How does this 1099-Thousand Threshold Change touch on how I apply PayPal and Venmo?

This change should not bear upon how you use PayPal and Venmo. You can all the same continue to use the PayPal and Venmo platforms every bit you practise right now, and the benefits that are offered by sending money via our goods and services P2P characteristic – including buyer and seller protections on eligible transactions for PayPal and Venmo.

Q: What information do I take to provide to PayPal and Venmo? What do I have to practice to ensure I remain compliant?

In the coming months, nosotros may ask you lot to provide revenue enhancement information like your Employer Identification Number (EIN), Private Tax ID Number (ITIN) or Social Security Number (SSN), if you haven't provided information technology to u.s.a. already. For background, generally businesses use an EIN, while sole proprietors and individuals volition apply an ITIN or Social Security Number.

Q: Why is this happening at present?

The 1099-Grand reporting requirement was part of the American Rescue Plan Human action of 2021 passed earlier this year by Congress and signed into law by the President. The effective date for these new changes is January one, 2022.

Q: Where tin can I detect more data?

Here are some further helpful resources if you wanted to read more than:

- Joint Commission on Tax Technical Explanation of Department 9674 of H.R. 1319, the "American Rescue Plan Deed of 2021." (March 2021)

- PWC, American Rescue Plan Act Lowers Class 1099-Yard Reporting Threshold (March 2021)

- IRS, Understanding Your Course 1099-One thousand

* Run across Venmo and PayPal Buy Protection terms and weather.

Disclaimer: PayPal does not provide tax communication. This content has been prepared for full general informational purposes only and is not intended to exist relied on for revenue enhancement advice. For questions regarding your specific circumstances, you should consult with a tax advisor.

Source: https://newsroom.paypal-corp.com/2021-11-04-New-US-Tax-Reporting-Requirements-Your-Questions-Answered

Posted by: farrelladlyinit.blogspot.com

0 Response to "Does Paypal Merchant Services Report Credit Card Sales To The Irs"

Post a Comment